14 Minutes

What is Tokenized Real Estate?

Tokenized real estate is a process that involves converting real estate assets or their cash flows into digital tokens stored on a blockchain. These tokens represent fractional ownership of the underlying property and can be traded or transferred easily. The concept leverages blockchain technology to enhance liquidity, transparency, and accessibility in real estate investments.

These tokens can be either non-fungible tokens (NFTs) or fungible tokens, depending on the nature of the asset and the investment structure.

Key Features:

- Fractional Ownership: Investors can own a fraction of a property, making real estate investment more accessible.

- Increased Liquidity: Tokens can be traded on secondary markets, providing more liquidity compared to traditional real estate investments.

- Transparency and Security: Blockchain technology ensures transparent and secure transactions.

- Smart Contracts: Automate various processes such as rent collection, property management, and compliance with regulations.

How is Tokenized Real Estate Governed?

Decentralized Autonomous Organizations (DAOs) play a transformative role in the tokenization of real estate by leveraging blockchain technology to enable collective ownership, governance, and management of real estate assets.

A Decentralized Autonomous Organization (DAO) is a type of organization that operates through rules encoded as computer programs called smart contracts, which are stored and executed on a blockchain.

Unlike traditional organizations, DAOs do not have a central authority or hierarchical management structure. Instead, they are governed by their members, who participate in decision-making processes through a transparent and democratic voting system.

Key Characteristics of DAOs

- Decentralization: DAOs are decentralized entities, meaning there is no central authority. Decision-making is distributed among the members, who use blockchain technology to coordinate tasks and governance without central oversight. [28][29]

- Smart Contracts: DAOs utilize smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute actions when predefined conditions are met. [28][30][31]

- Transparency and Trustlessness: Transactions and rules within a DAO are transparent and can be audited by anyone. Trust is established through code rather than relying on individuals or a central authority. [28][32]

- Voting Mechanisms: DAO members often participate in decision-making through voting mechanisms. Each member’s voting power may be proportional to their stake or holdings within the DAO. [28][32]

- Tokenized Ownership: DAOs typically issue tokens that represent ownership or voting rights within the organization. Members hold these tokens as a way to participate in governance and decision-making. [28][32]

Role of DAOs in Real Estate Tokenization

Here’s a detailed look at how DAOs are involved in this process:

1. Collective Ownership and Investment

- Fractional Ownership: DAOs allow multiple investors to own fractions of a real estate asset through digital tokens. This democratizes access to high-value properties that would otherwise be out of reach for individual investors.

- Pooling Resources: Investors can pool their resources to collectively purchase and manage real estate, spreading risk and reducing the capital required from each investor.

2. Governance and Decision-Making

- Decentralized Governance: DAOs enable token holders to participate in decision-making processes related to the management of the property. This includes decisions on maintenance, lease agreements, property improvements, and even the sale of the property.

- Smart Contracts: Governance is often automated through smart contracts, which execute predefined rules and voting mechanisms, ensuring transparency and efficiency in decision-making.

3. Transparency and Security

- Blockchain Transparency: All transactions and decisions are recorded on the blockchain, providing clear and immutable records for all stakeholders. This fosters trust and accountability among investors.

- Security: Blockchain technology ensures that the ownership and transaction records are secure and tamper-proof, reducing the risk of fraud.

4. Liquidity and Accessibility

- Increased Liquidity: Tokenized real estate can be traded on secondary markets, providing investors with greater liquidity compared to traditional real estate investments.

- Global Access: Investors from around the world can participate in real estate investments without geographical limitations, broadening the investor base and increasing market efficiency.

5. Cost Efficiency

- Reduced Administrative Costs: Smart contracts can automate various administrative tasks associated with property management, potentially leading to lower operational costs for the DAO.

- Efficient Capital Raising: DAOs can raise capital more efficiently by attracting international investors through token sales, bypassing traditional financial intermediaries.

Governance Structure of Real Estate DAOs

Examples of Real Estate DAOs

- CityDAO: Aims to collectively purchase, manage, and develop real estate, with each token holder having a voice in major decisions.

- Lofty: Allows users to buy tokens representing shares in a property, collect rent proportional to their token shares, and vote on property management proposals.

- Harbor: Facilitates fractional ownership of real-world properties, giving investors voting rights on decisions like renovations or rentals

Key Takeaways: DAOs represent a revolutionary approach to organizational management, leveraging blockchain technology to create transparent, democratic, and autonomous entities. They offer numerous advantages over traditional organizations but also face significant challenges that need to be addressed as the technology and regulatory landscape evolve.

How is Tokenized Real Estate Regulated?

Regulation of tokenized real estate varies by jurisdiction and involves compliance with securities laws, anti-money laundering (AML) regulations, and know your customer (KYC) standards.

Regulatory Considerations

- Securities Laws: Real estate tokens are often classified as securities and must comply with regulations set by bodies like the U.S. Securities and Exchange Commission (SEC).

- KYC/AML Compliance: Platforms must verify the identities of investors and ensure that funds are not derived from illegal activities.

- Accredited Investor Requirements: In many jurisdictions, only accredited investors can participate in certain tokenized real estate offerings to protect less experienced investors.

Compliance Measures:

- Proactive Compliance: Platforms prioritize adherence to existing laws to ensure long-term viability.

- Transparency: Providing clear information regarding legal structures, rights associated with tokens, and compliance measures.

- Investor Education: Offering resources to help investors understand the complexities and risks associated with tokenized real estate.

Key Takeaways: Tokenized real estate offers significant advantages in terms of accessibility, liquidity, and efficiency, making it an attractive option for a broader range of investors. However, it also comes with challenges, particularly in navigating the evolving regulatory environment and ensuring compliance with securities laws. By understanding these aspects, investors and platforms can navigate the evolving landscape of real estate tokenization effectively.

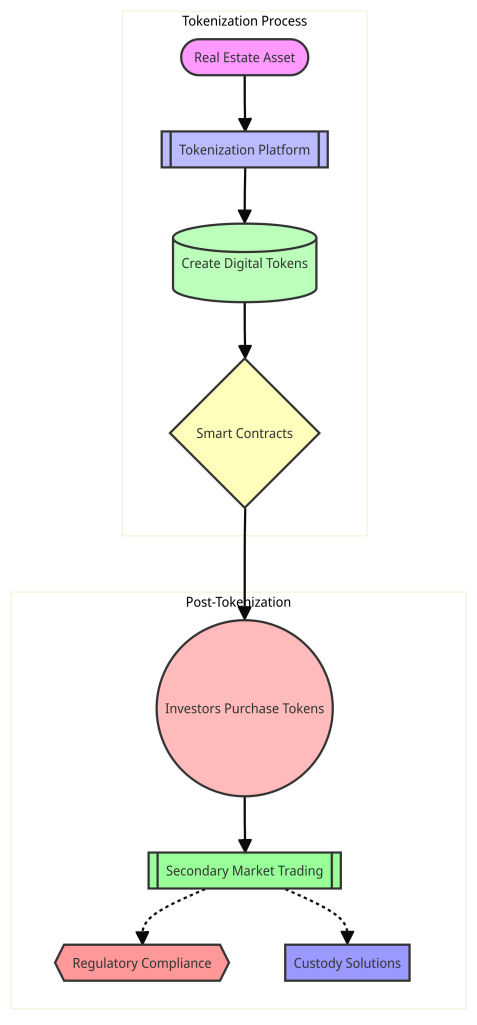

Understanding the Tokenization Process

The tokenization of real estate refers to the process of converting real estate assets into digital tokens that are stored on a blockchain. These tokens represent fractional ownership of the underlying property, allowing for the asset to be divided into smaller, more manageable pieces that can be bought, sold, and traded more easily. This process leverages blockchain technology to enhance transparency, security, and liquidity in real estate transactions.

Tokenization Process

| Step | Description |

|---|---|

| Real Estate Agent | The process begins with the selection and evaluation of a property by a real estate agent or property owner. This involves assessing the property’s location, value, and market demand to ensure it is a suitable candidate for tokenization. |

| Tokenization Platform | A tokenization platform is chosen to facilitate the creation and management of digital tokens. These platforms provide the necessary infrastructure for issuing tokens, managing investor communications, and ensuring compliance with regulatory requirements. |

| Create Digital Token | Digital tokens representing fractional ownership of the property are created. This involves defining the number of tokens, their value, and the ownership rights they confer. The tokens are then minted and issued to investors. |

| Smart Contracts | Smart contracts are developed and deployed on the chosen blockchain platform. These self-executing contracts automate various aspects of the tokenized asset, such as ownership transfers, rental income distribution, and compliance with legal and regulatory requirements. |

Post-Tokenization

| Step | Description |

|---|---|

| Investors Purchase Tokens | Investors can purchase the digital tokens through private sales or public offerings. This allows them to acquire fractional ownership of the property, making real estate investment more accessible and affordable. |

| Secondary Market Trading | Once the tokens are issued, they can be traded on secondary markets. This provides liquidity to investors, allowing them to buy and sell their tokens without waiting for the property to be sold. |

| Regulatory Compliance and Custody Solutions | Ensuring regulatory compliance is crucial throughout the tokenization process. This includes adhering to securities laws, performing KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, and maintaining secure custody solutions for the digital tokens. |

Key Takeaways: Real estate tokenization represents a significant shift from traditional real estate investment methods, offering numerous advantages and some challenges. Tokenization allows for fractional ownership of real estate assets, opening up investment opportunities to a wider range of individuals. This method also provides increased liquidity, lower barriers to entry, and the potential for diversification across different properties.

Traditional vs. Tokenized Real Estate

Here’s a detailed comparison that distinguishes the six major differences between traditional and tokenized real estate:

1. Accessibility and Capital Requirements

Traditional Real Estate Investment

- High Capital Requirements: Traditional real estate investments often require substantial capital outlay, making it difficult for small investors to participate. Properties can cost hundreds of thousands to millions of dollars, creating a high barrier to entry[1][2][3].

- Limited Accessibility: Investment opportunities are typically limited to those with significant financial resources and access to specific markets[1][2].

Tokenized Real Estate Investment

- Fractional Ownership: Tokenization allows for fractional ownership, enabling investors to buy smaller shares of a property. This lowers the financial barrier to entry and democratizes access to real estate investments[1][2][3][5].

- Global Market Access: Tokenization opens up global investment opportunities, allowing investors from anywhere in the world to participate in real estate markets that were previously inaccessible[1][2][3][4].

2. Liquidity

Traditional Real Estate Investment

- Illiquidity: Real estate is traditionally considered an illiquid asset class. Selling a property can take months or even years due to the lengthy processes involved, such as property inspections, securing financing, and title searches[1][2][3][5].

- Limited Secondary Market: There is typically no secondary market for fractional ownership in traditional real estate, making it difficult to quickly liquidate investments[1][2].

Tokenized Real Estate Investment

- Enhanced Liquidity: Tokenized real estate can be traded on secondary markets, much like stocks or cryptocurrencies. This allows for quicker and easier buying and selling of property shares, significantly improving liquidity[1][2][3][4][5].

- 24/7 Market: Tokenized assets can be traded around the clock, providing continuous liquidity and flexibility for investors[4].

3. Transparency and Security

Traditional Real Estate Investment

- Complex Transactions: Traditional real estate transactions involve numerous intermediaries, such as brokers, lawyers, and banks, which can introduce complexity and potential for discrepancies or fraud[1][2][3].

- Limited Transparency: The involvement of multiple parties can obscure the transaction process, making it less transparent[1][2].

Tokenized Real Estate Investment

- Blockchain Technology: Tokenization leverages blockchain technology to provide an immutable and transparent record of ownership and transactions. This reduces the risk of fraud and increases trust among market participants[1][2][3][4][5].

- Smart Contracts: Automated smart contracts can handle various aspects of property management, such as rent collection and ownership transfers, reducing administrative costs and enhancing transparency[2][4][6].

4. Diversification

Traditional Real Estate Investment

- High Costs of Diversification: Diversifying a real estate portfolio traditionally requires significant capital to acquire multiple properties in different regions or property types[1][2][3].

- Geographic Limitations: Investors are often constrained by geographic limitations and familiarity with local markets[1][2].

Tokenized Real Estate Investment

- Easy Diversification: Tokenization allows investors to diversify their portfolios by purchasing fractional shares of various properties across different regions and property types. This can be done with much smaller amounts of capital compared to traditional methods[1][2][3][4][5].

- Global Reach: Investors can easily diversify their holdings globally, accessing real estate markets worldwide[1][2][3][4].

5. Speed of Transactions

Traditional Real Estate Investment

- Slow Transactions: Traditional real estate transactions can be slow, often taking weeks or months to complete due to the need for inspections, financing, and legal processes[1][2][3][5].

Tokenized Real Estate Investment

- Quick Transactions: Tokenized real estate transactions can be completed in minutes, as they avoid many of the time-consuming processes associated with traditional real estate. The transfer of ownership can happen almost instantly on the blockchain[1][2][3][4][5].

6. Regulatory and Legal Considerations

Traditional Real Estate Investment

- Established Regulations: Traditional real estate investments are governed by well-established legal and regulatory frameworks, providing a clear understanding of rights and obligations[2][8][12].

Tokenized Real Estate Investment

- Evolving Regulations: The regulatory environment for tokenized real estate is still evolving, with varying rules and compliance requirements across different jurisdictions. This can create uncertainty for investors and issuers[2][8][12][13].

- Need for Compliance: Tokenized real estate platforms must ensure compliance with securities laws, anti-money laundering regulations, and other legal requirements, which can be complex and challenging[2][8][12][13].

Real World Use Cases for Tokenized Real Estate

Tokenized real estate is revolutionizing the property investment landscape by leveraging blockchain technology to fractionalize ownership, enhance liquidity, and democratize access to real estate assets. Here are four notable real-world use cases that highlight the transformative potential of real estate tokenization.

St. Regis Aspen Resort

One of the pioneering examples of real estate tokenization is the St. Regis Aspen Resort in Colorado. In 2018, Elevated Returns, a New York-based asset management firm, tokenized 18.9% of this luxury resort through an Initial Coin Offering (ICO), raising $18 million in the process. Investors could purchase “Aspen Coins,” which represented shares in the property. This initiative allowed a broader group of retail investors to own a piece of this high-value asset, demonstrating the potential of tokenized real estate to democratize traditionally exclusive markets and enable small-scale investor participation[25][26][27].

Roofstock’s Tokenized Homes

Roofstock, a fintech and single-family rental platform, has successfully tokenized residential properties, facilitating transactions via Ethereum-based NFTs. For instance, a Georgia home was sold to ReaIT, a platform offering fractional real estate investment in tokenized assets. This transaction allowed investors from various countries to own shares in U.S. real estate, showcasing how tokenization can open up global investment opportunities. Roofstock has also sold homes in Alabama and Florida through NFT marketplaces, further illustrating the practical application of blockchain technology in real estate[22].

RealT’s Fractional Real Estate Investments

RealT is a platform that enables fractional real estate investment through blockchain technology. Investors can purchase digital tokens representing ownership in U.S. residential properties for as little as $50. RealT’s model reduces the time to purchase real estate from a minimum of 30 days to just 30 minutes, significantly enhancing liquidity and accessibility. The platform also offers weekly rent payments to token holders, providing a steady income stream secured by blockchain technology. This approach has made real estate investment more accessible and efficient for a wider range of investors[21][23][24].

Lueneburg Historical Building

In a unique application of tokenization, a historical building in Lueneburg, Germany, was tokenized to preserve its heritage while attracting diverse investors. The Lueneburg community raised $1.5 million through this initiative, allowing investors to own a fraction of the property and benefit from an annual interest rate of 5%. This case highlights how tokenization can be used not only for modern real estate projects but also for preserving and investing in historical properties, thereby combining cultural preservation with innovative investment strategies[26].

Key Takeaways: These real-world use cases demonstrate the versatility and potential of real estate tokenization. By fractionalizing ownership, enhancing liquidity, and democratizing access, tokenization is reshaping the real estate investment landscape. As blockchain technology continues to evolve and regulatory frameworks become more defined, the adoption of tokenized real estate is likely to expand, offering new opportunities for investors and property owners alike.

Conclusion

Real estate tokenization presents a myriad of advantages over traditional real estate investment. These include increased liquidity, lower barriers to entry, enhanced transparency, and easier diversification, all of which contribute to a promising and dynamic investment landscape. Despite facing challenges such as regulatory uncertainty and the need for robust technological solutions, the ongoing evolution of technology and regulatory frameworks holds the potential to significantly transform the real estate investment space through tokenization.

Thank you for reading my blog post. If you found this topic engaging, I invite you to explore more of my content on Decentralized Intelligence and dive deeper into similar topics.

Continue your journey!

Citations:

[1] https://www.linkedin.com/pulse/comparing-traditional-real-estate-investment-tokenized-gaincre

[2] https://www.forbes.com/sites/forbestechcouncil/2023/05/22/the-future-of-real-estate-tokenization-and-its-impact-on-the-industry/

[3] https://primior.com/why-tokenized-real-estate-is-the-future-of-property-investment/

[4] https://ninjapromo.io/the-ultimate-guide-to-real-estate-tokenization

[5] https://www.parvisinvest.com/insights/how-real-estate-tokenization-is-disrupting-traditional-investment

[6] https://www.linkedin.com/pulse/what-real-estate-tokenization-how-does-work-solulab

[7] https://vestaequity.net/resources/blog-the-transition-from-traditional-real-estate-investing-to-tokenized-home-equity-investments

[8] https://primior.com/is-real-estate-tokenization-legal/

[9] https://www.zoniqx.com/resources/revolutionizing-property-markets-the-comprehensive-guide-to-real-estate-tokenization

[10] https://www.linkedin.com/pulse/real-estate-tokenization-vs-reits-exploring-two-paths-robert-muoka

[11] https://www.eisneramper.com/insights/real-estate/real-estate-tokenization-0921/

[12] https://usp.io/regulations-and-compliance-in-real-estate-tokenization/

[13] https://www.forbes.com/sites/digital-assets/2024/03/20/real-estate-tokenization-a-start-of-a-new-era-in-property-management/

[14] https://www.antiersolutions.com/top-10-real-estate-tokenization-companies-in-2024/

[15] https://vegavid.com/blog/real-estate-tokenization-company-in-2024/

[16] https://www.matthews.com/can-real-estate-tokenization-revolutionize-the-industry/

[17] https://synodus.com/blog/blockchain/real-estate-tokenization-companies/

[18] https://redswan.io/the-benefits-of-tokenization-for-real-estate-developers/

[19] https://lenderkit.com/blog/top-5-real-estate-tokenization-software/

[20] https://antematter.io/blogs/property-tokenization-real-estate

[21] https://ninjapromo.io/the-ultimate-guide-to-real-estate-tokenization

[22] https://blockworks.co/news/tokenized-real-estate-crypto

[23] https://faq.realt.co/en/articles/7143779-the-benefits-of-tokenized-real-estate

[24] https://realt.co

[25] https://blog.nebeus.com/guide-to-tokenized-real-estate/

[26] https://realbox.io/blogs/top-6-successful-cases-of-real-estate-tokenization

[27] https://www.hitechnectar.com/blogs/use-cases-tokenization/

[28] https://corporations.utah.gov/2023/12/15/decentralized-autonomous-organization-dao/

[29] https://blog.colony.io/what-is-the-difference-between-a-dao-and-a-company/

[30] https://www.winston.com/en/legal-glossary/what-is-a-decentralized-autonomous-organization-dao

[31] https://www.avast.com/c-what-is-dao

[32] https://www.gemini.com/cryptopedia/dao-crypto-decentralized-governance-blockchain-governance

Discover more from Decentralized Intelligence

Subscribe to get the latest posts sent to your email.

Maximize your brand’s reach with expert social media marketing UAE! Engage your audience, drive traffic, and grow your business with tailored strategies.

LikeLike

real estate digital marketing is key to success in today’s market, utilizing SEO, social media, and targeted ads to reach potential buyers and sellers efficiently.

LikeLike